New publication on the effectiveness of emissions taxes in reducing air pollution

Researchers from the IESE Business School of the University of Navara in Spain, the WHU–Otto Beisheim School of Management in Germany, the German Remote Sensing Data Center (DFD) of the German Aerospace Center (DLR) in Germany and our Earth Observation Research Cluster (EORC) of the University of Würzburg teamed up for a study on the effectiveness of emission taxes in reducing air pollution. This article is the result of interdisciplinary co-operation of remote sensing scientists, geographers and economists. The paper titled “How effective are emission taxes in reducing air pollution? A satellite-based case study for Spain” was just published in the journal Economic Analysis and Policy by Thilo Erbertseder, Martin Jacob, Hannes Taubenböck and Kira Zerwer.

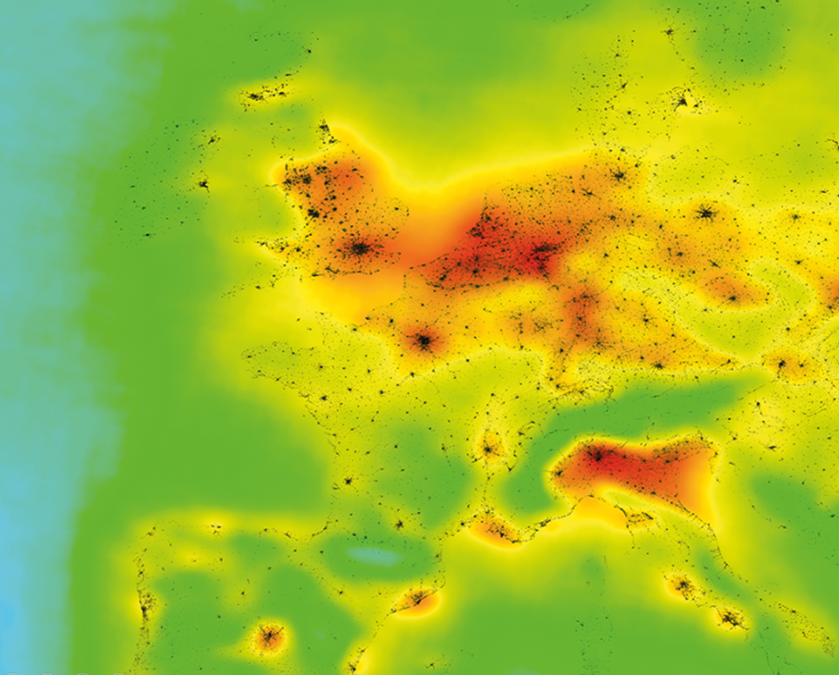

Here is the abstract of the paper: Air pollution poses significant risks to public health and the environment. Policymakers aim to counteract these risks by implementing policies to reduce pollution and emissions. Emission taxes are a prominent market-based tool. However, their real-world effectiveness remains underexplored. This study evaluates the impact of an economically significant tax on nitrogen oxide (NOx) introduced in the Comunidad Valenciana in 2013 compared to the rest of Spain using a difference-in-differences framework. To measure the area-wide spatiotemporal changes in air pollution, the study leverages satellite-based NO2 data. The findings reveal that the emission tax achieved a modest 1.2 % decline in NO2 levels annually, equivalent to approximately 728 tons of NOx emissions. In a series of robustness tests, heterogeneity analysis highlights stronger reductions in industrial areas, innovative firms, and larger companies, emphasizing the role of technological capacity. In contrast, firms with significant market power tend to shift the tax burden to stakeholders instead, thereby reducing its environmental impact. These results suggest that emission taxes have an effect in the intended direction; however, the effect alone does not significantly curb NO2 pollution. Complementary measures, such as innovation incentives and stricter regulatory standards, are necessary to enhance their effectiveness. By providing granular evidence of emission taxes’ real-world impacts, this study offers valuable insights for policymakers designing targeted and efficient environmental policies.

Here is the link to the full paper: https://www.sciencedirect.com/science/article/pii/S0313592625001420

This research is part of our work on air pollution, see e.g. here:

- https://www.sciencedirect.com/science/article/pii/S2542519624001207

- https://ieeexplore.ieee.org/document/10572220

- https://ieeexplore.ieee.org/document/10579815

- https://www.sciencedirect.com/science/article/pii/S0034425721005599

- https://link.springer.com/article/10.1007/s00103-020-03177-w

- https://link.springer.com/chapter/10.1007/978-3-662-44841-0_20